Company Maintenance - Closing a Period

Company Maintenance - Closing a Period

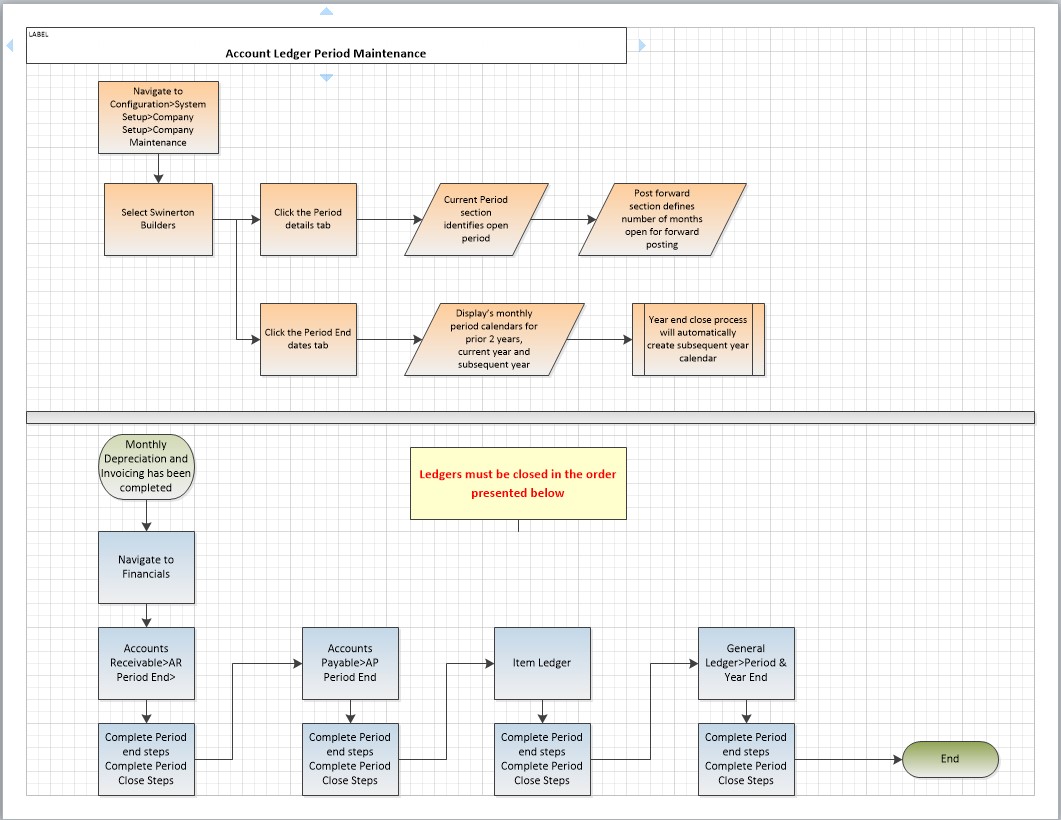

NOTE:This document is a guide for the Finance Department in maintaining account ledger periods (opened/closed) in Rental Results. There are four (4) ledgers used in Results, AR. AP, Item and GL. Each ledger period must be Ended and Closed to move the period calendars forward. The flowchart below is a high level view of the process. This material is based on the current Workshop Environment set up.

Each Ledger must be closed in the following order AR, AP, Item and GL. You cannot close GL if one of the other ledgers is still open. If there are any open transactions found when attempting to close any of the ledgers, these transactions must be completed using the “Utilities>Financial Batch Recovery” steps.

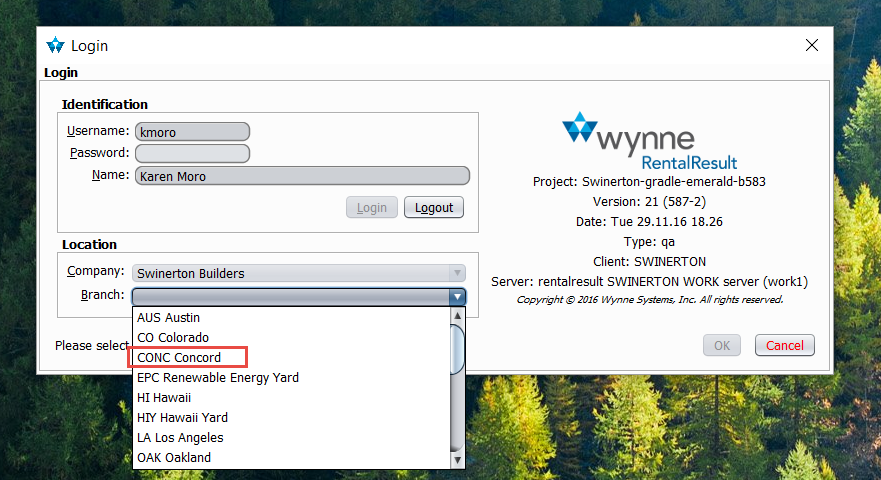

STEP 1: Log into Rental Results CORE

STEP 2: Choose Concord as the Branch

Closing AR

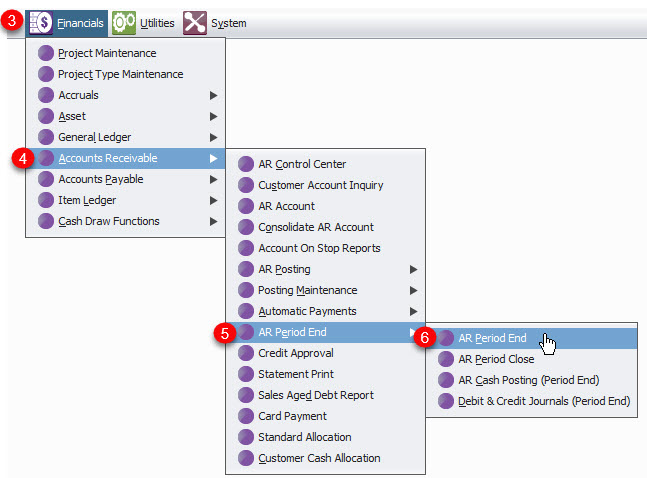

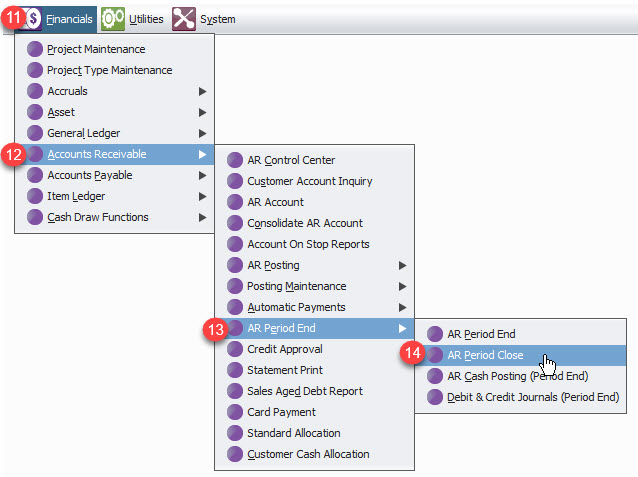

STEP 3: Click Financials

STEP 4: Click Accounts Receivable

STEP 5: Click AR Period end

STEP 6: Click AR Period end

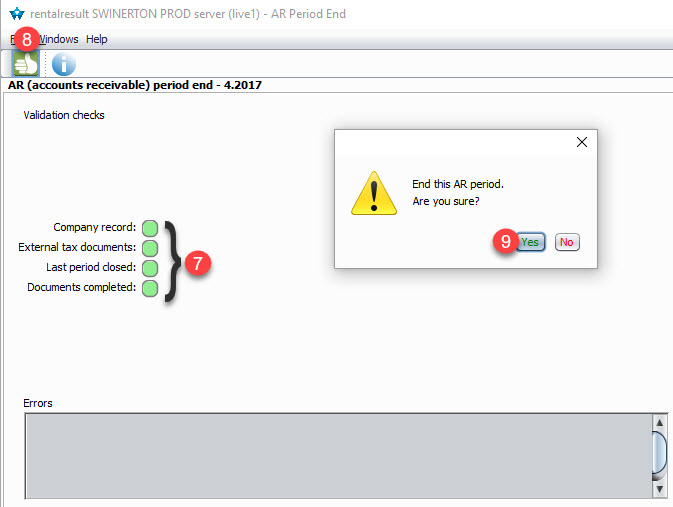

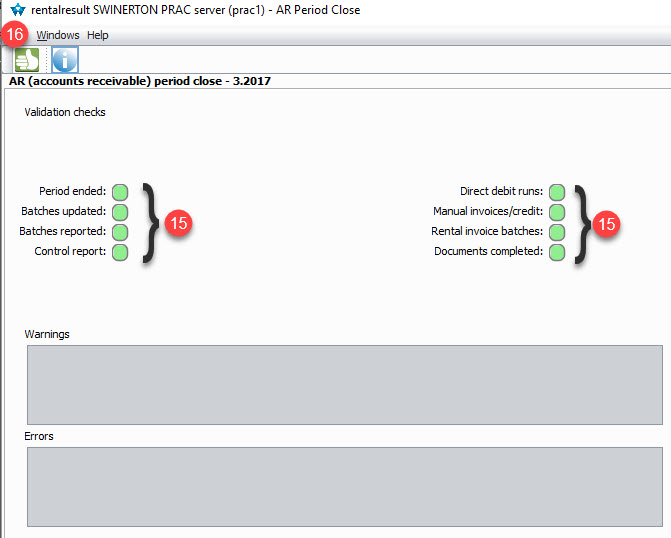

STEP 7: Validate that all checks are Green

STEP 8: Click the "Thumbs Up" icon

STEP 9: Click Yes

STEP 10: Click the X to exit

NOTE:Transactions that have not been completed or previous periods that have not been closed would be reflected with a “RED” circle. These transactions need to be completed prior to continuing with the current processes. The same applies to the Period Close processes

STEP 11: Click Financials

STEP 12: Click Accounts Receivable

STEP 13: Click AR Period End

STEP 14: Click AR Period Close

STEP 15: Validate that all boxes are Green

STEP 16: Click the "Thumbss Up" icon

STEP 17: Click Yes

STEP 18: Click the X to exit

Closing AP

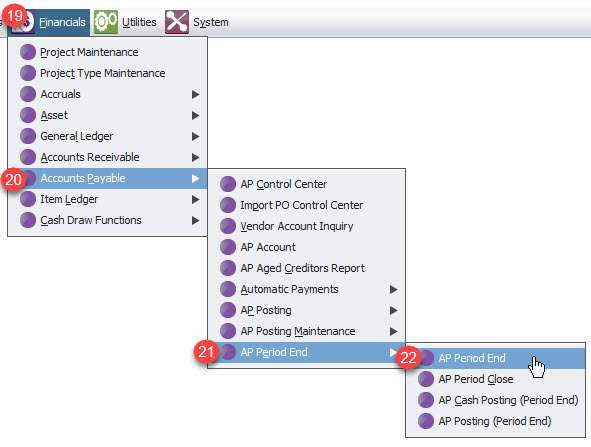

STEP 19: Click Financials

STEP 20: Click Accounts Payable

STEP 21: Click AP Period End

STEP 22: Click AP Period End

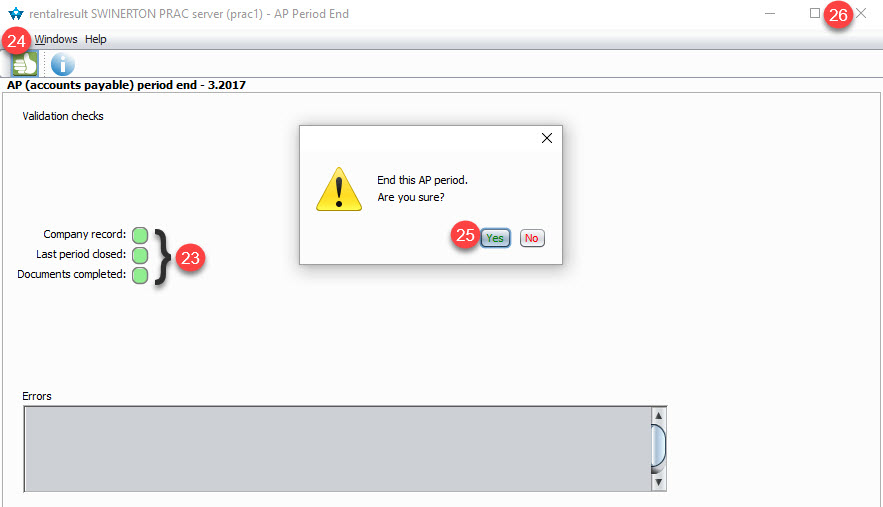

STEP 23: Validate that all boxes are Green

STEP 24: Click the "Thumbs Up" icon

STEP 25: Click Yes

STEP 26: Click the X to exit

NOTE:Transactions that have not been completed or previous periods that have not been closed would be reflected with a “RED” circle. These transactions need to be completed prior to continuing with the current processes. The same applies to the Period Close processes

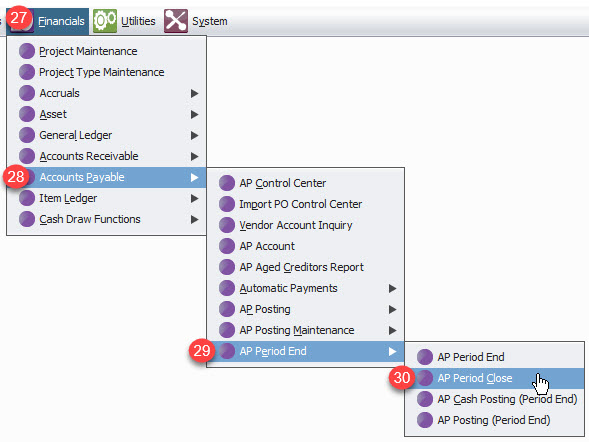

STEP 27: Click Financials

STEP 28: Click Accounts Payable

STEP 29: Click AP Period End

STEP 30: Click AP Period Close

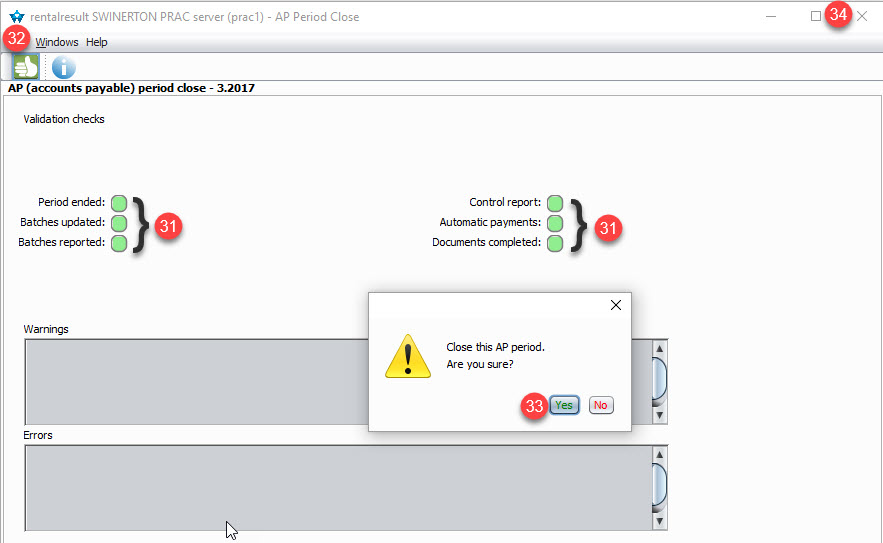

STEP 31: Validate that all boxes are Green

STEP 32: Click the "Thumbs Up" icon

STEP 33: Click Yes

STEP 34: Click the X to exit

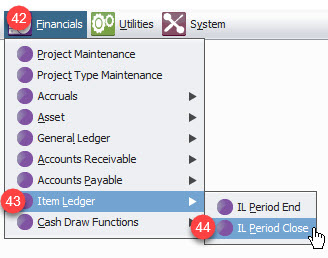

Closing Item Ledger

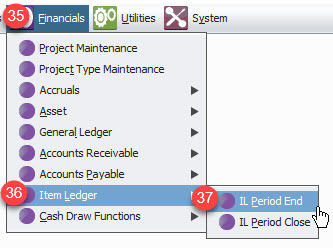

STEP 35: Click Financials

STEP 36: Click Item Ledger

STEP 37: Click IL Period End

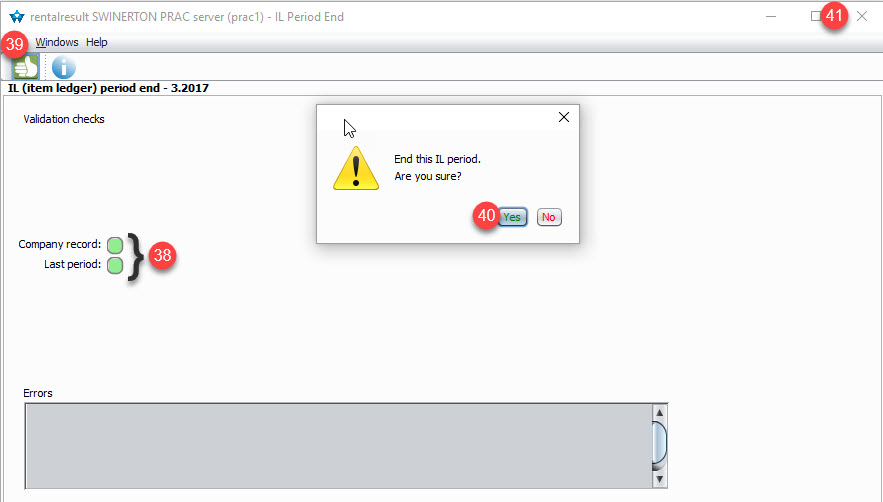

STEP 38: Validate that all boxes are Green

STEP 39: Click the "Thumbs Up" Icon

STEP 40: Click Yes

STEP 41: Click the X to exit

NOTE:Transactions that have not been completed or previous periods that have not been closed would be reflected with a “RED” circle. These transactions need to be completed prior to continuing with the current processes. The same applies to the Period Close processes.

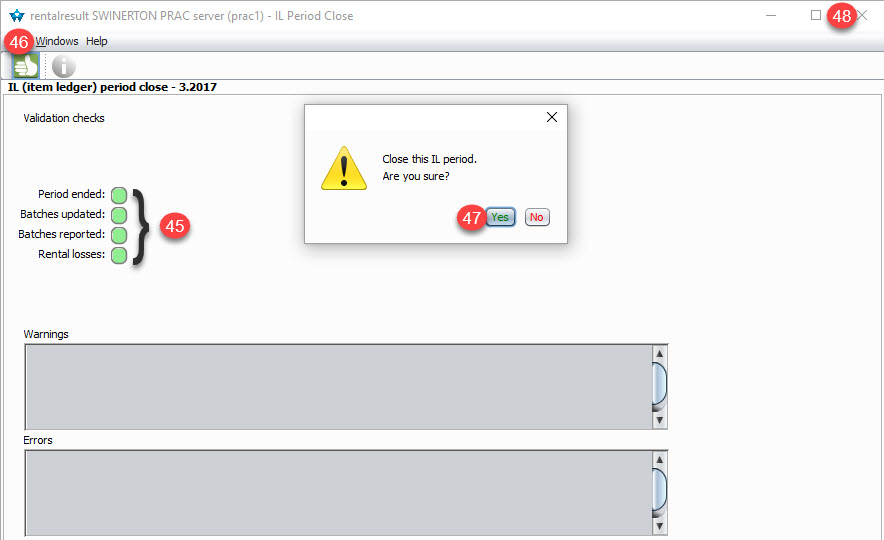

STEP 42: Click Financials

STEP 43: Click Item Ledger

STEP 44: Click IL Period Close

STEP 45: Validate that all boxes are Green

STEP 46: Click the "Thumbs Up" Icon

STEP 47: Click Yes

STEP 48: Click the X to exit

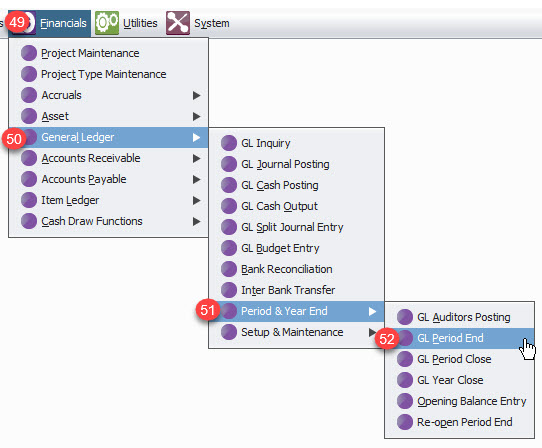

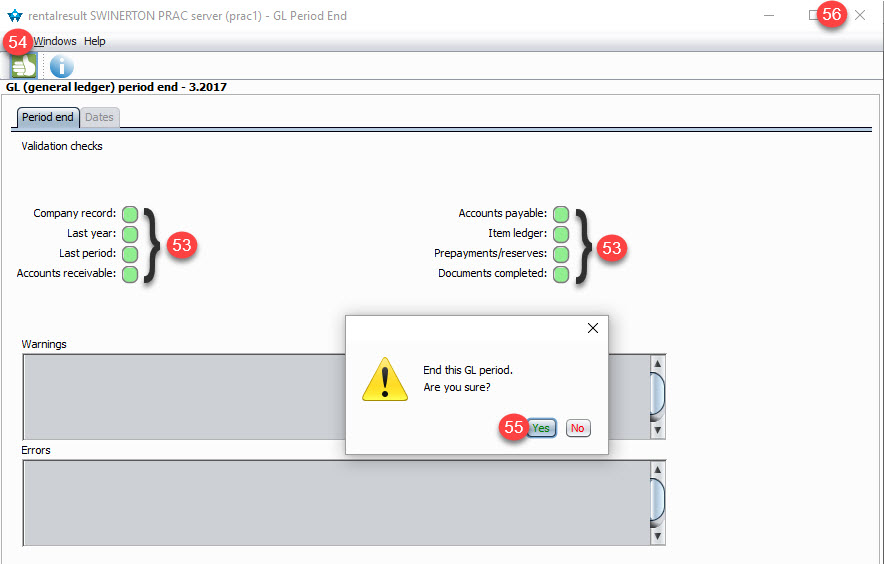

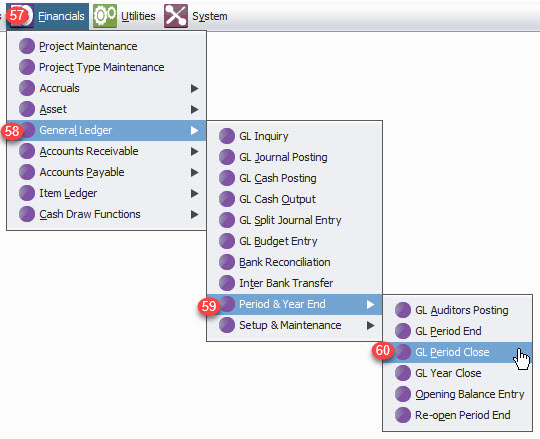

Closing General Ledger

STEP 49: Click Financials

STEP 50: Click General Ledger

STEP 51: Click Period & Year End

STEP 52: Click GL Period End

STEP 53: Validate that all boxes are Green

STEP 54: Click the "Thumbs Up" Icon

STEP 55: Click Yes

STEP 56: Click the X to exit

NOTE:Transactions that have not been completed or previous periods that have not been closed would be reflected with a “RED” circle. These transactions need to be completed prior to continuing with the current processes. The same applies to the Period Close processes

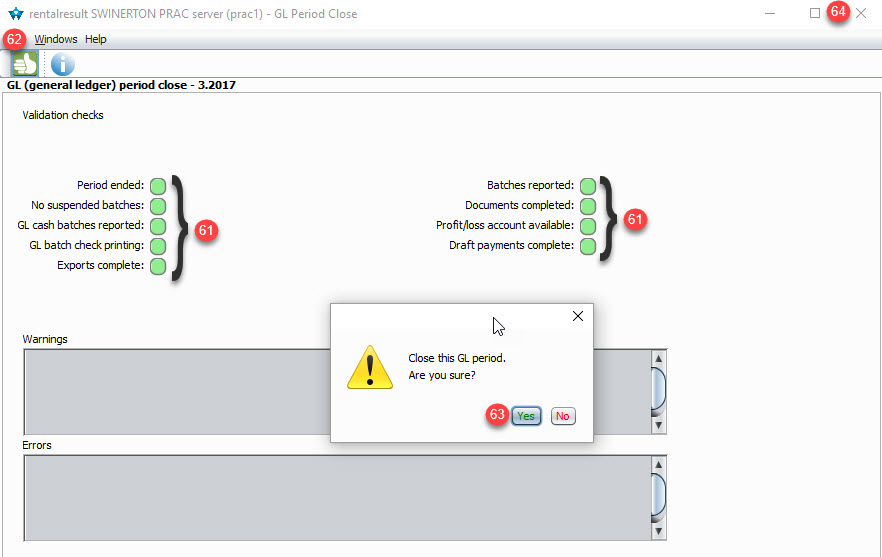

STEP 57: Click Financials

STEP 58: Click General Ledger

STEP 59: Click Period & Year End

STEP 60: Click GL Period End

STEP 61: Validate that all boxes are Green

STEP 62: Click the "Thumbs Up" Icon

STEP 63: Click Yes

STEP 64: Click the X to exit