Job Billing - Process Owner Billing

Job Billing - Process Owner Billing

Preparing the Contract

This step should have been completed during the Job Setup process. The Contract setup should be confirmed prior to the first Owner Billing.

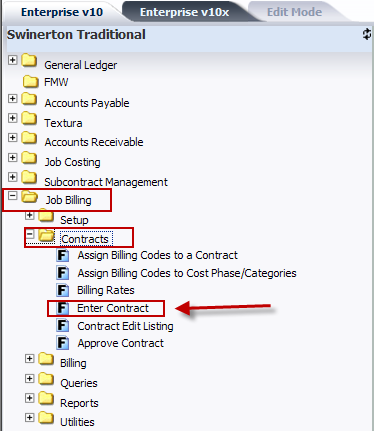

Navigation:

Job Billing – Contracts – Enter Contract

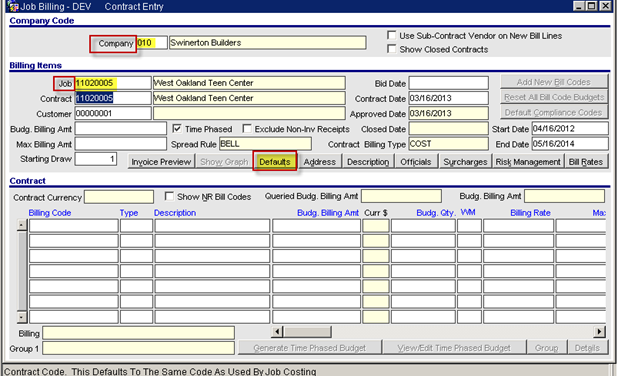

Ensure that the Company

is correct, and press F11 then F9 in the Job field. Select the proper job. Alternatively, press F11, enter the

job number, then press F12.

Press the Defaults

button.

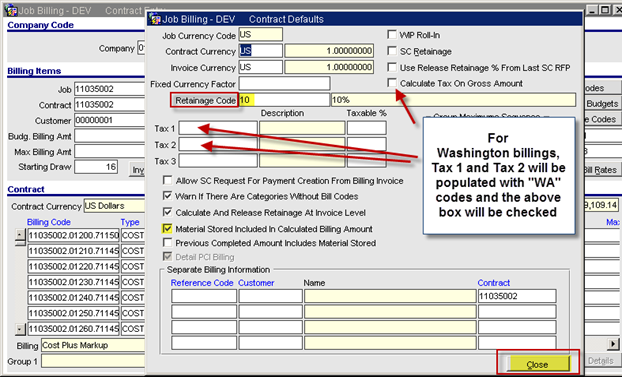

Validate/update

the settings for Retainage Code (initially setup by the FM).

If the job is

located in Washington, there will be “WA” codes in the Tax 1 and Tax

2 fields so the system will calculate Washington sales taxes for each

billing. Also, the box will be checked

in the Calculate Tax on Gross

Amount field.

For jobs located

in Canada, the “CN” code will show in the Tax 1 field. The box will be unchecked in the Calculate

Tax on Gross Amount field so the system will calculate tax based on the net

billings amount.

Click the Close

button.

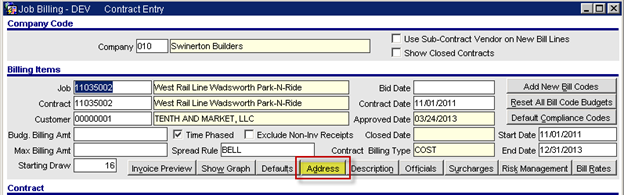

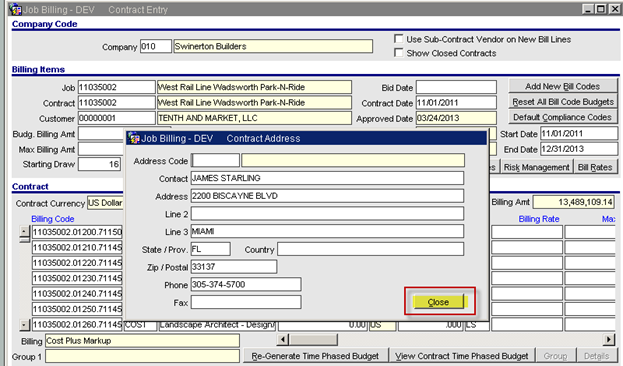

Click

the Address button to see what will be displayed on the Job Billing AIA

form as the Project Address.

Note

that for go-live and several months thereafter, Swinerton will process

“one-line” billings in CMiC and continue to present Excel-based billings to

owners. When the company decides to use

more detailed invoice formats and present system-generated billings to owners,

then you may need to change the customer address information (e.g. sending

billings to alternative locations).

Click

the Close button.

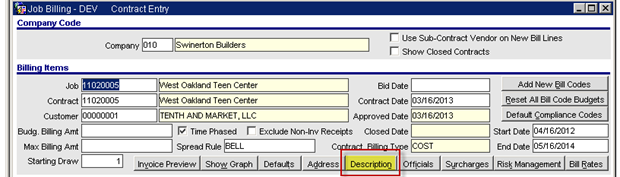

Click on

the Description button.

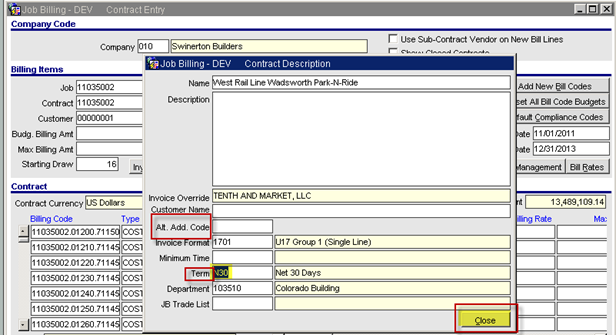

The

existing contract name will appear in the Name field.

The Description

field can be used to enter notes and will not be printed anywhere.

Invoice

Format 1701

should be displayed. If not, press F9 or double-click in the field.

In the Term

field, press F9 and select the billing terms (typically N30).

Click

the Close button.

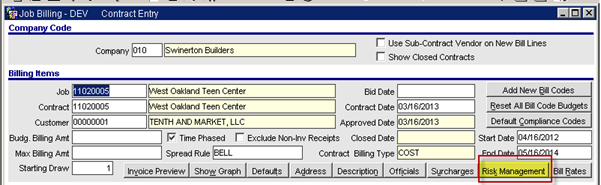

Click

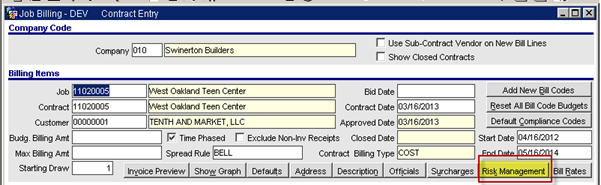

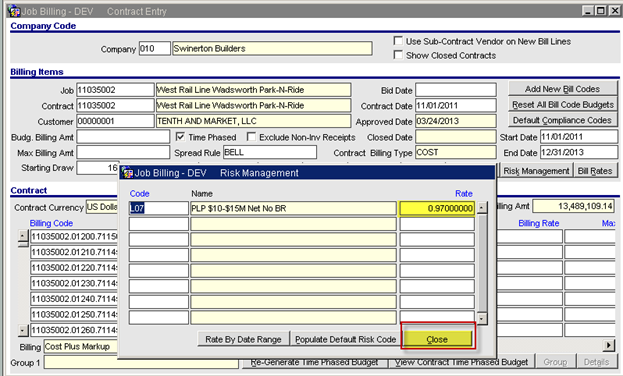

the Risk Management button to validate/update insurance and GRT (if

applicable) rates, which may have already been selected by the Financial

Manager.

The

system will automatically generate insurance and GRT (if applicable) job cost

transactions based on the gross billing amount.

The costs will land

in the current period and, by default, will be billed in the next accounting

period.

Click

the Close button.

Note: Bill Rates are setup to equal Charge Rates

(except for SMC). So, there is no need

to click the Bill Rates button and

make changes.

The remaining steps in this section

should be performed after the PM has loaded the job budget.

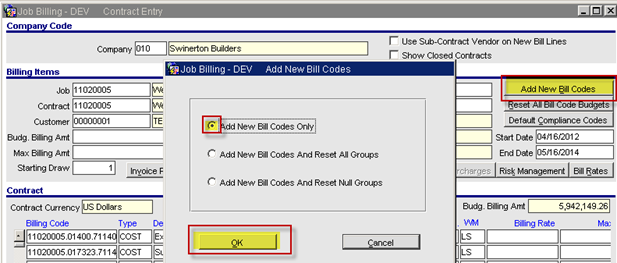

Click

the Add New Bill Codes button. This step adds any phases or categories

to the Contract that may have been added by the Project Manager since the

Billing Contract was entered or last updated, and must be performed before every billing.

Click

OK (the default “Add New Bill Codes Only” is appropriate).

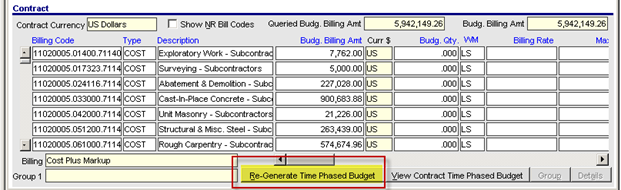

Press

the Page Down key on your keyboard or click on the button near the top of the screen to populate

the Contract.

button near the top of the screen to populate

the Contract.

Click Page Down and click the Generate (or

Re-Generate) Time Phased Budget button.

Time phasing of revenue must be

performed before WIP is processed for the first time.

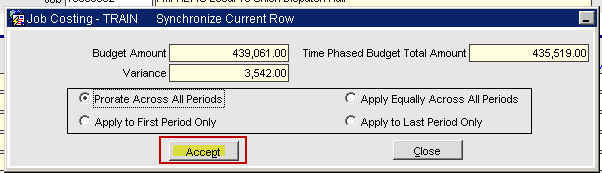

If the Synchronize

button is red, click it to adjust the projected revenue amount.

You will then be

prompted to choose how to spread the adjustment, or if additional periods are

needed. Just click the Accept

button.

Press F3

or the Save icon and then F4 to exit the screen.

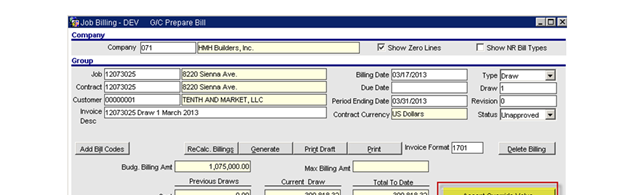

Preparing the Billing

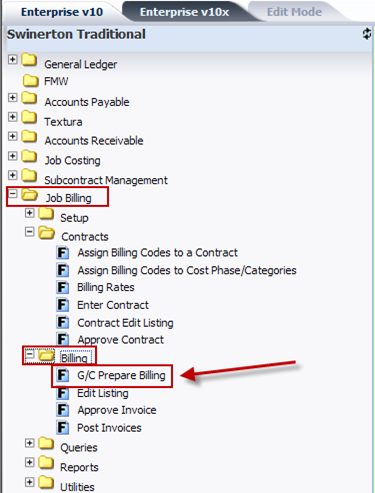

Navigation:

Job Billing - Billing – G/C Prepare

Billing

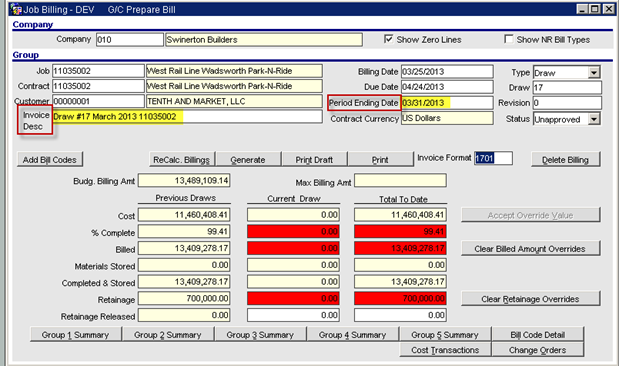

Ensure the

appropriate Company number displays in the top block.

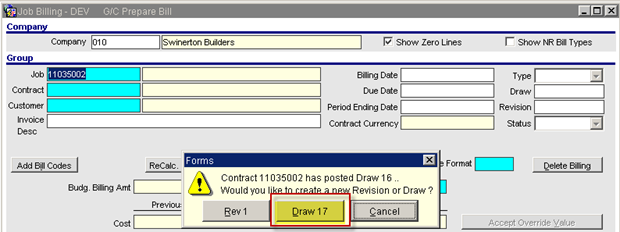

In the next

block, input the Job number, press F12 or click the Draw #

button.

If you are

prompted, click OK.

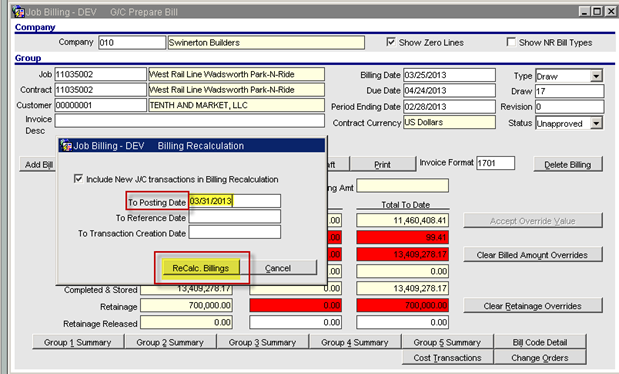

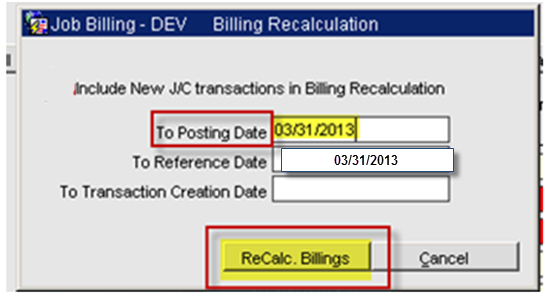

A pop-up box

appears and the user must “recalculate” the billing amount. By default, “Include New J/C (Job Cost)

transactions in Billing Recalculation” is checked.

Delete

the date in the “To Reference Date” field.

In the “To

Posting Date” field, input the date as follows:

If you are

entering a billing during the early part of a month (e.g. June 3rd) prior to

billing cutoff, enter the last day of the prior month (05/31/2013) to

capture transactions posted in the open period.

If you are entering a billing

after billing cutoff, simply enter the current day’s date (e.g. June

9th) to capture cost transactions for the billing through that date.

Click ReCalc.

Billings.

By default, the

system shows the date that the billing is created in the Billing Date

field, the Due Date is based on contract terms, and the Period End Date is

the last day of the open period.

If you are entering a billing

after billing cutoff, simply enter the current day’s date (e.g. June

9th).

Note: The posting date of the transaction is

selected in the posting process (see page 14).

Enter a

description (job #, draw #, GL date, etc.) in the Description field.

In the screen

shot above, note that the system displays Previous, Current and Total

To Date amounts for Cost, Billing (gross) and Retainage, as

well as other data.

If you get a

pop-up box that says “Warning: Job/Phase/Categories exist without being mapped to Contract (Job #),” just

click OK.

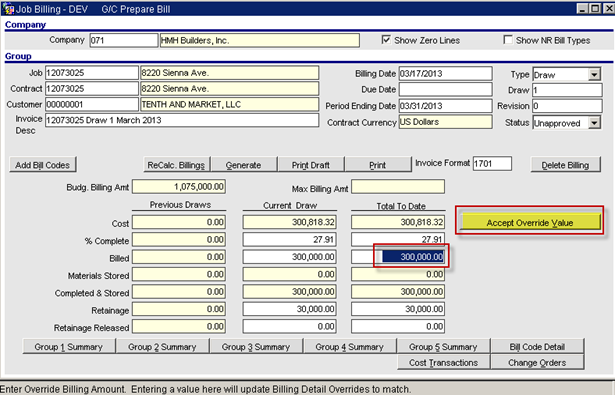

On the main

screen of G/C Prepare Bill, you may override amounts in the Current Draw or Total to Date

“Billed” white fields by entering new amounts and immediately clicking the Accept

Override Value button.

Overrides will

be displayed in a red background and do not represent errors.

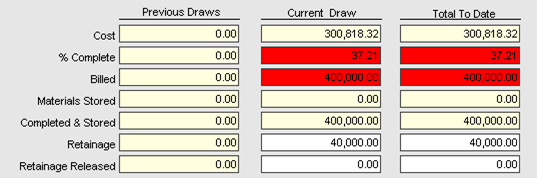

Total To Date

Billed amount overridden from $300,000 to $400,000. Retainage automatically recalculated

but that amount may be overridden.

Click the ReCalc. Billings

button.

At the pop-up box, simply click the ReCalc. Billings button again (no

changes needed).

Next, click the Generate

button and click OK at the pop-up

box.

Next, click the Print

button and then click Run Report.

Check that billing amounts

match your input screen.

Click Cancel at next prompt.

The main screen shows the

billing amounts.

Finally, press F3

to save and F4 to exit (click OK if prompted).

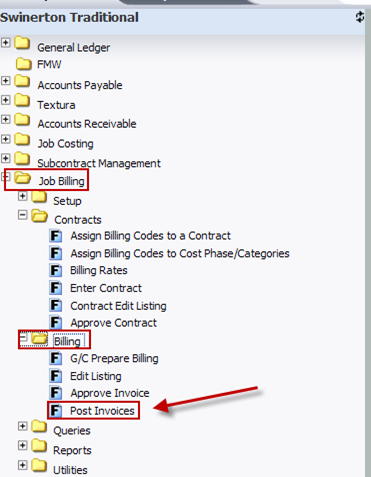

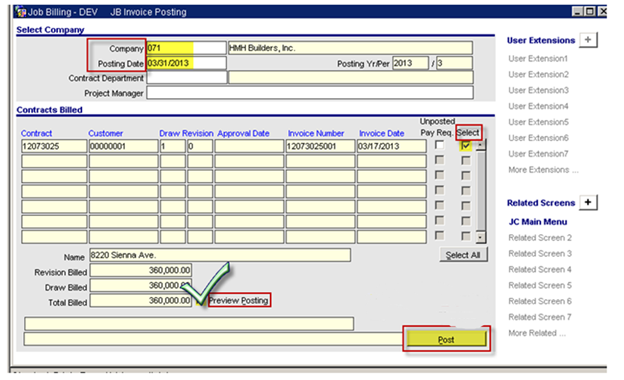

Posting the Billing

Navigation:

Job Billing - Billing – Post

Invoices

Ensure the Company

number is correct.

If you are

posting a billing during the early part of a month (e.g. June 3rd) prior to

billing cutoff, enter the last day of the prior month (05/31/2013).

If you are entering a billing

after billing cutoff, simply enter the current day’s date (e.g. June

9th).

Click Page Down,

check the box in the Select column

, and the click in the box next to Preview

Posting.

Click Post. That will create three pre-posting reports and does not actually

post the billing.

When prompted,

click Run Reports.

Ensure

that the proper GL date, gross billing and retention amounts, and other

details are correct. Close the reports screen and return to the

posting screen.

Finally, just click the Post button to post the transactions.