Job Cost - How to Enter Transactions (Journal Entries)

Job Cost - How to Enter Transactions (Journal Entries)

Overview: How to enter transactions (Journal Entries)

Journal Entries are entered into CMiC using the Enter Cost

or Billing Transaction process. Journal Entries with a large number of detail lines

or entries from another source such as E1 can be imported into CMiC using the Foreign Batch (See Import Transactions

and Post (Foreign Batch Import)). This

document details:

· Entering a Journal Entry

· Entering an Accrual Journal Entry with Automatic

Reversal

· Printing JC Transaction Edit Listing

· Correcting an Unposted Batch

· Posting a Batch

Entering a

Transaction (Journal Entry)

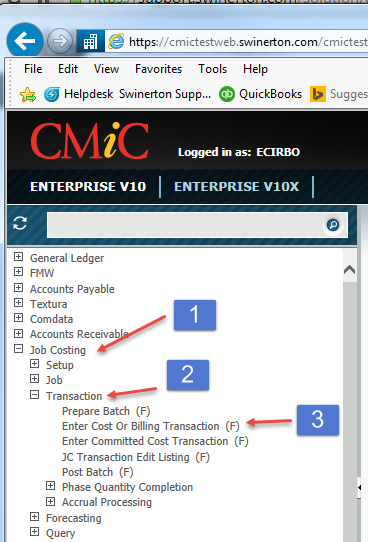

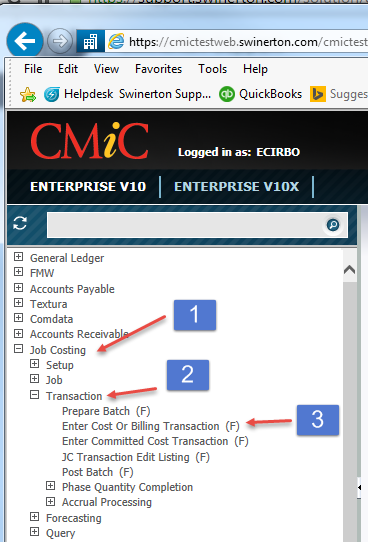

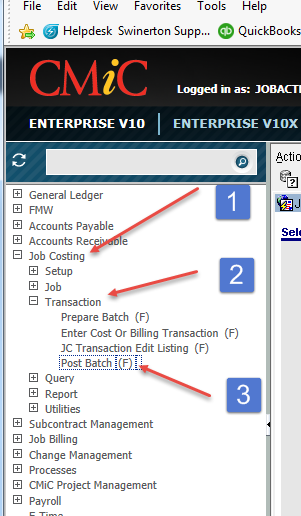

STEP 1: Click

Job Costing

STEP 2: Click

Transaction

STEP 3: Click

Enter Cost or Billing Transaction

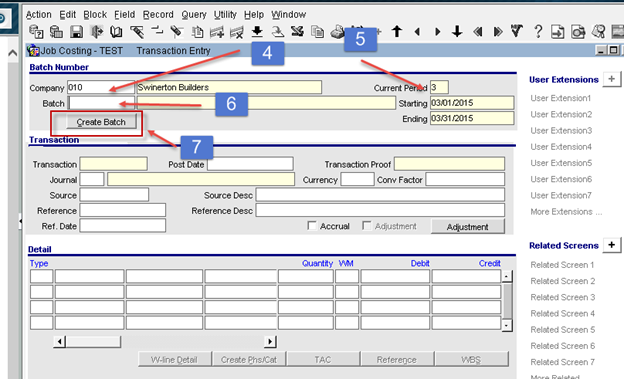

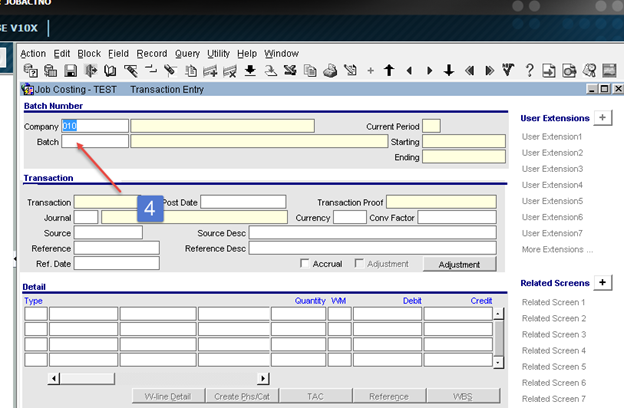

STEP 4: Company number will default based on User

Defaults. Can be changed in necessary.

STEP 5: Current Period will default based on

open period.

STEP 6: Click

in the Batch field and the Create Batch button will appear.

STEP 7: Click

Create Batch (See Creating a Batch in

Enterprise). Once batch is selected

or created, Page Down.

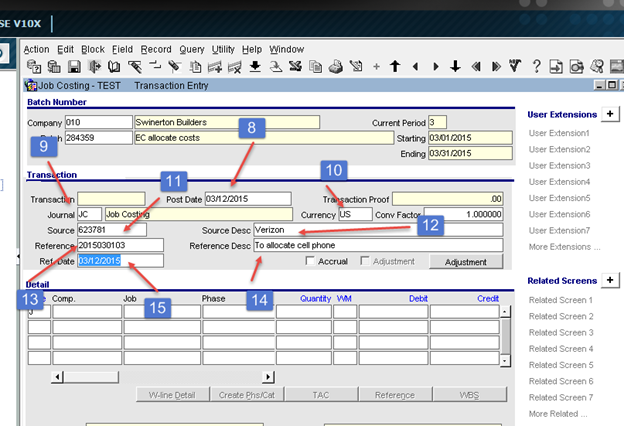

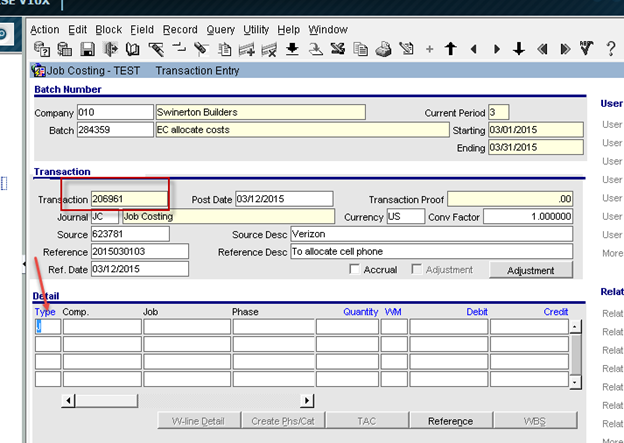

STEP 8: Post Date - System Date will default. Note: Post Date must be within the Current

Period and can be changed. Press Tab

STEP 9: Journal – Enter “JC”. Press Tab

STEP 10: Currency – Defaults “US”. Press Tab,

Press Tab

STEP 11: Source – Enter source of entry if

desired, i.e. Vendor Number. This will

appear on queries and reports. Press Tab

STEP 12: Source Desc – Enter source description

in desired, i.e. vendor’s name, invoice #, etc.

This will appear of queries and reports.

Press Tab

STEP 13: Reference – Enter JE number. Press Tab

STEP 14: Reference Desc – Enter JE description.

Press Tab

STEP 15: Ref.

Date - Defaults to system date. This

can be changed to the source date of the transaction. Press Tab

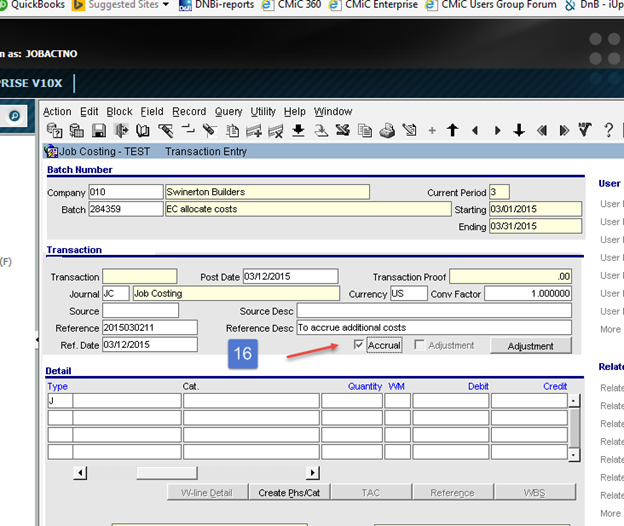

NOTE: If Accrual

box is checked this entry will automatically be reversed the following

period. See section below for using this

feature.

Transaction

number will populate and cursor will move to Detail Section of screen.

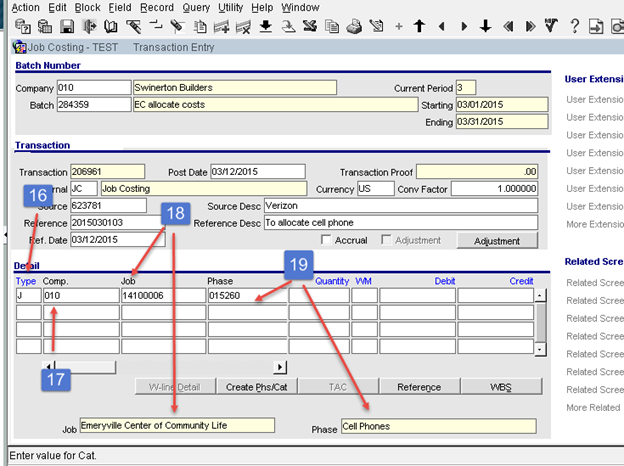

STEP 16: Type – Will default to “J”. Only change to “G” if posting entry to a

Balance Sheet account. Press Tab

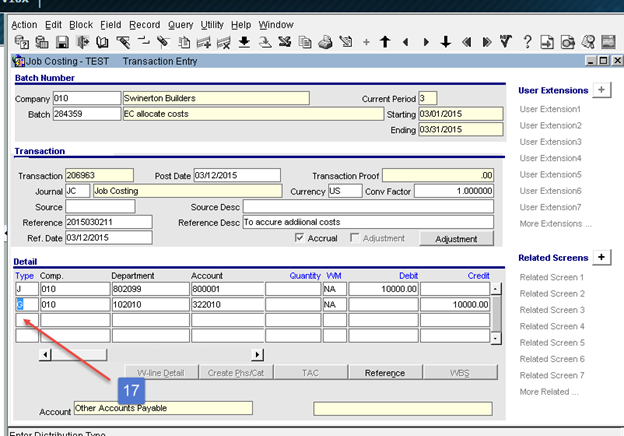

STEP 17: Comp.

– Company number will default from Company in Header. This can be changed to another company if

this is an intercompany transaction. Press Tab

STEP 18: Job –

Enter job or overhead number. If this is

a “G” line, this field can be blank. Type “J” requires a job number. Press Tab

STEP 19: Phase

– Enter or query Phase number. Press Tab

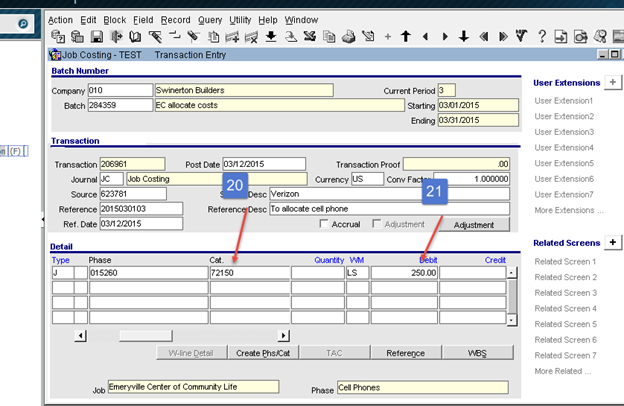

STEP 20: Cat. – Enter or query Category number. Tab

over to Debit field.

STEP 21: Debit - Enter amount of debit. Arrow down and you

will be taken to next line.

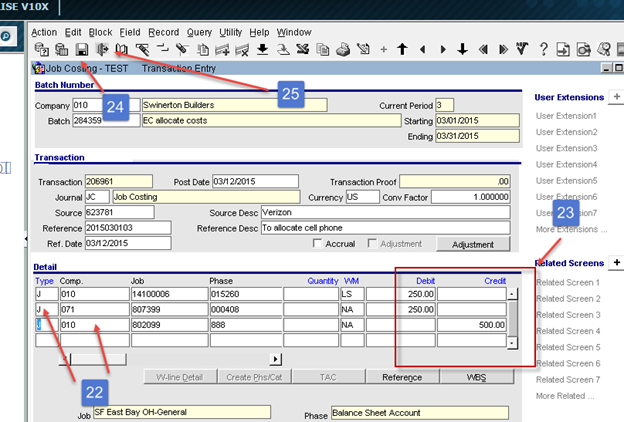

STEP 22: Continue

adding remaining lines.

STEP 23: When

all lines are entered, your Debits must equal Credits. You will not be able to save the record if

the entry does not balance.

STEP 24: Click

the Save Icon. The record will save and the screen will be blank. You can add another entry at this time

following the steps above.

STEP 25: Once

all the transactions have been entered, click the Close Icon.

Entering an Accrual with Automatic Reversal

Journal Entries can automatically be reversed the following period by checking the Accrual box in the Transaction section. Checking this box creates both the current transaction and the reversing transaction when the batch is posted.

Follow Steps

1 – 15 above.

STEP 16: Click Accrual

box. Entry will automatically be

reversed and posted to the next period. Page down.

STEP 17: Enter

Details - Follow steps 16 – 25 above.

Note: In this example we are using

Type = “G” since the entry is a balance sheet item.

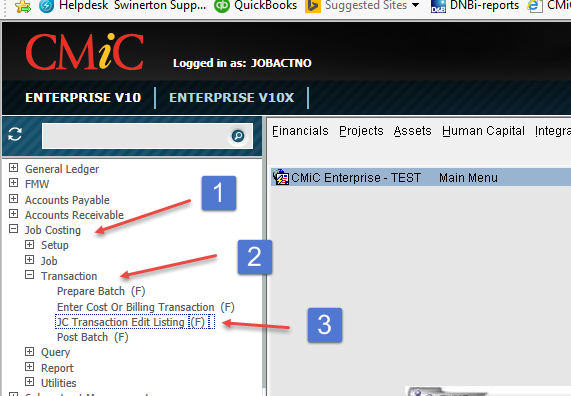

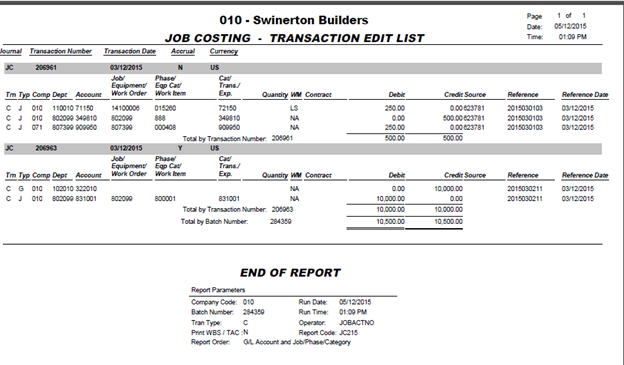

Print JC

Transaction Edit Listing

STEP 1: Click

Job Costing

STEP 2: Click

Transaction

STEP 3: Click

JC Transaction Edit Listing

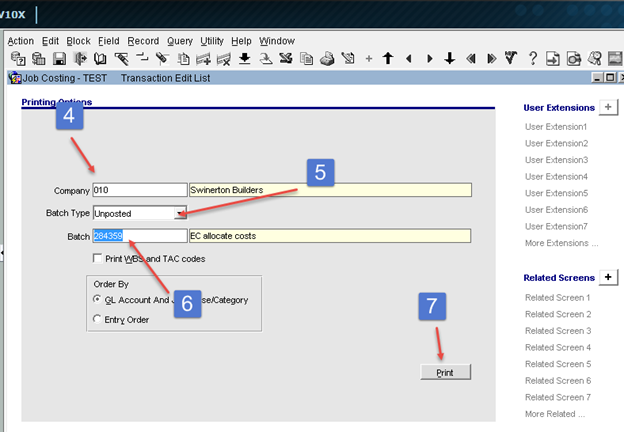

STEP 4: Company – Will default based on User Defaults.

STEP 5: Batch Type – Defaults to “Unposted”. “Posted” can be selected for previously posted

batches.

STEP 6: Enter

or query Batch number.

STEP 7: Click

Print.

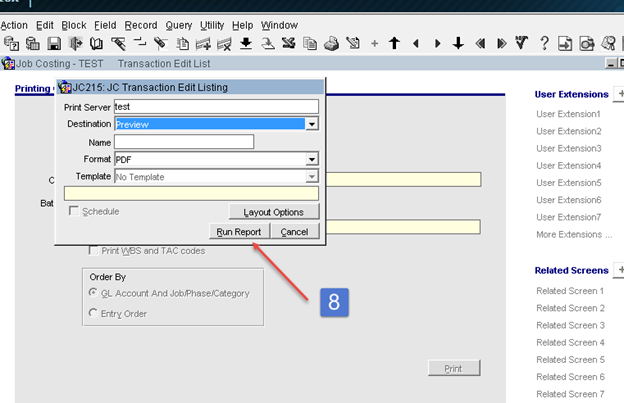

STEP 8: Click

Run Report.

· Do not change Destination to “Printer”, leave as

“Preview”. This will open in PDF and you

can print to printer at that time.

Review Report for accuracy (See Correcting Unposted Batches below).

Correcting an Unposted Batch

Transactions can be edited or deleted prior to posting by

querying the batch and making the necessary corrections. Additional entries can also be added to the

batch prior to posting.

STEP 1: Click

Job Costing

STEP 2: Click

Transaction

STEP 3: Click

Enter Cost or Billing Transaction

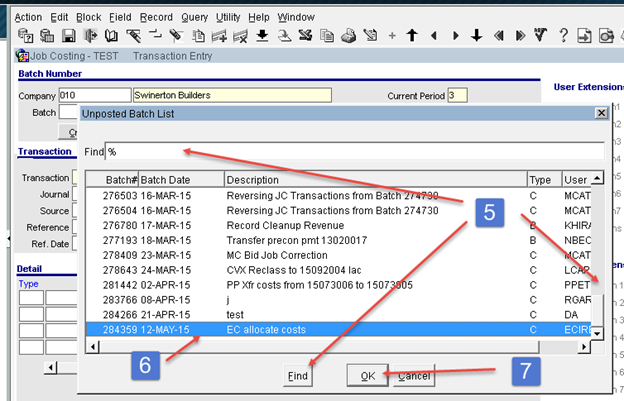

STEP 4: Double

click in the Batch field.

STEP 5: Locate

Batch by using scrollbar or querying and then clicking Find.

STEP 6: Highlight

Batch.

STEP 7: Click

OK. Page Down

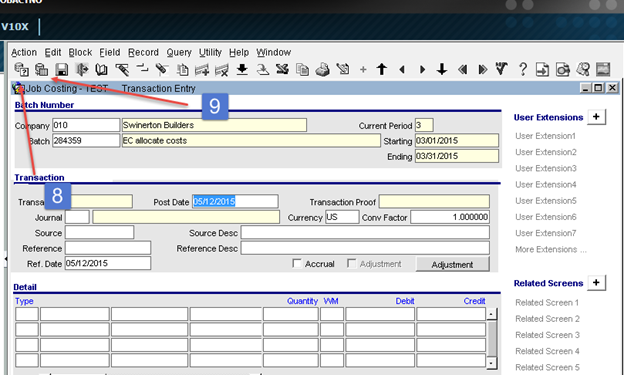

Screen will be blank. If you want to add a transaction, you

can do so at this time. If correcting

entry, you must locate the Transaction to change.

STEP 8: Click

the Enter Icon or F11. Screen will turn blue.

STEP 9: Click

the Execute Icon or F12. The first

record in the batch will populate the screen.

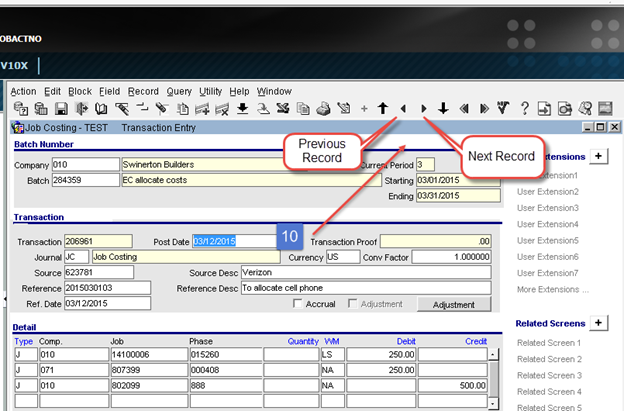

STEP 10: Locate

the Transaction by using the Previous and Next record Icons.

Make any necessary corrections.

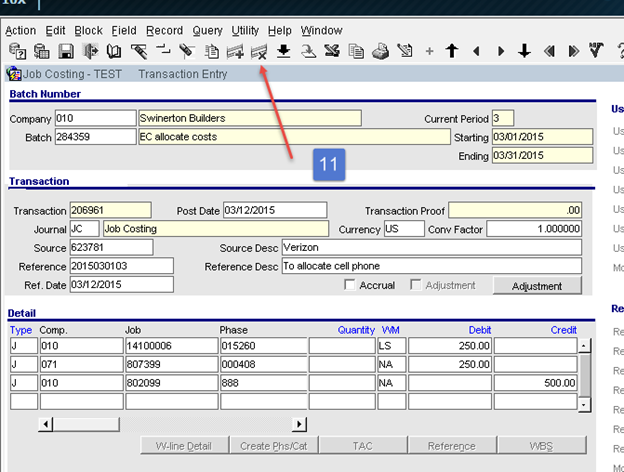

STEP 11: Records

can be deleted by clicking the Remove Icon.

STEP 12: Once

editing is completed, Save and Close screen.

Post Batch

STEP 1: Click

Job Costing

STEP 2: Click

Transaction

STEP 3: Click

Post Batch

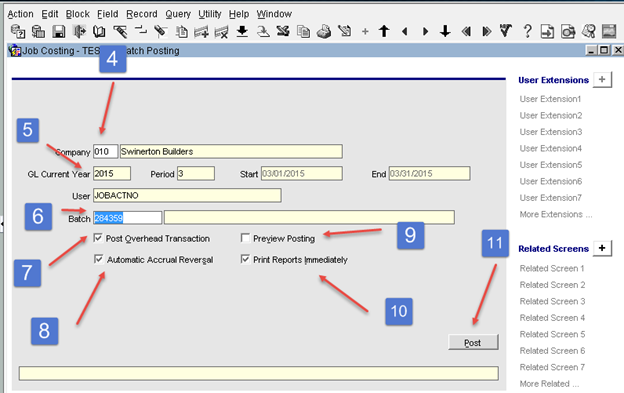

STEP 4: Company – Defaults based on User

Default setting.

STEP 5: GL Current Year Period – Defaults to

open period.

STEP 6: Enter

or Query Batch.

STEP 7: Post Overhead Transactions – Defaults checked.

Leave check.

STEP 8: Automatic Accrual Reversal – Defaults checked. This will create and post the reversing entry

if you checked the Accrual box on a Transaction. If you remove the check, your accrual must be

manually reversed.

STEP 9: Preview Posting – Only check this box

if you want to view the report prior to posting. Checking this box and click “Post” does not

post the batch.

STEP 10: Print Reports Immediately – Check this

box to review posting reports.

STEP 11: Click Post.

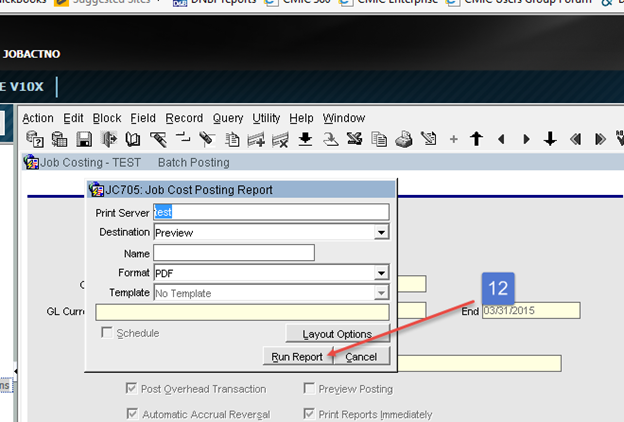

STEP 12: Click

Run Report.

· Do not change Destination to Printer. This will open in PDF and you can print to

printer at that time.

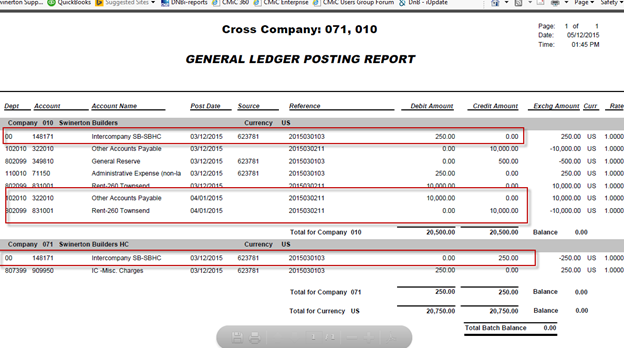

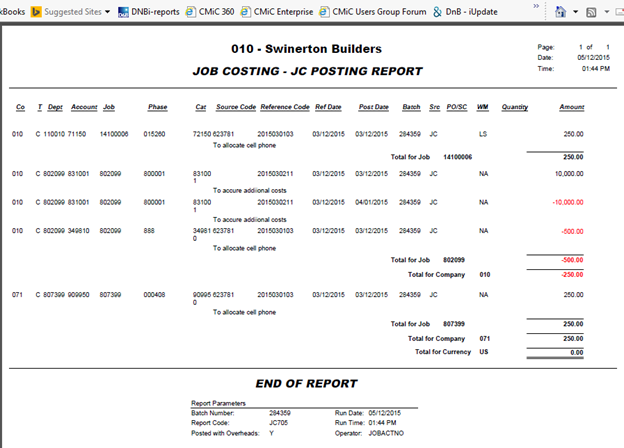

Job Cost Report will open.

STEP 13: Click

Run Report again.

General Ledger Report will open.

· NOTE: Accrual Reversal for following month was

posted.

· System automatically created Intercompany

Transaction.