Import Transactions and Post (Foreign Batch Import)

Foreign Batch Import Process

Overview: How to import Transactions into CMiC and post

Transactions or Journal Entries can be entered directly into CMiC using the

Foreign Batch Import Utility. Transactions can also be imported by creating

transactions in Excel and importing the file into CMiC using the Foreign Batch

process. This is useful when you have

multiple transactions or transactions with many lines of distribution.

The following

steps detail how to create the import file and how to import and post the file

in CMiC.

Generate Excel

Import File

For a file to successfully import and post in CMiC, it must be created using the attached template and must include

all mandatory fields with data in the correct format.

Foreign Batch Template can be saved for future use. The file Foreign Batch Example will be used

for the following process.

STEP 1: Open Foreign Batch Example file for testing. This file contains field descriptions and example transactions. Foreign Batch Template is a clean copy to use in future.

STEP 2: Complete all mandatory fields as noted on file.

· Yellow = Mandatory all lines

· Orange = Mandatory J-Lines

· Blue = Mandatory G-Lines

J or G

must be in caps

STEP 3: Save File as .csv (comma delimited) – Note location where saved.

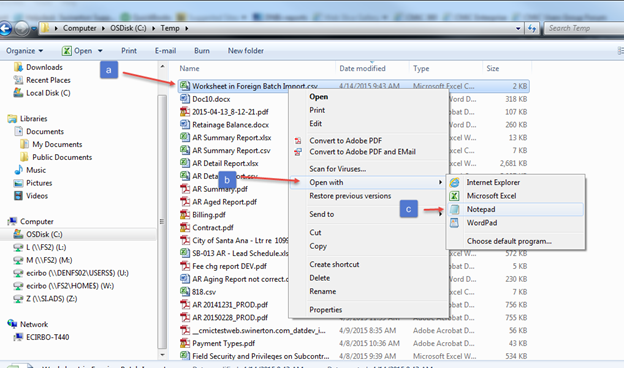

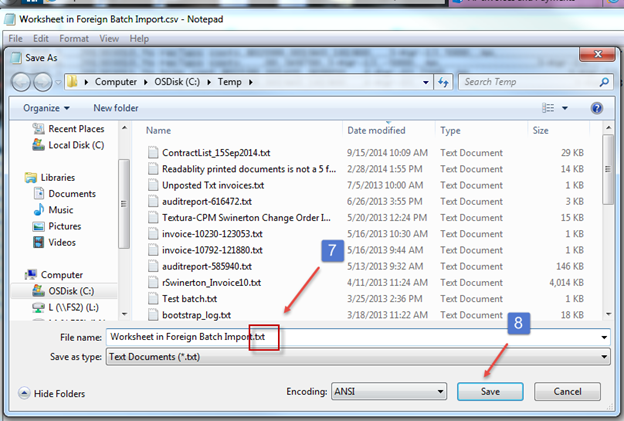

STEP 4: Convert the .csv file to .txt file using Notepad

OR

Right-click on file > select "Open with" > choose Notepad

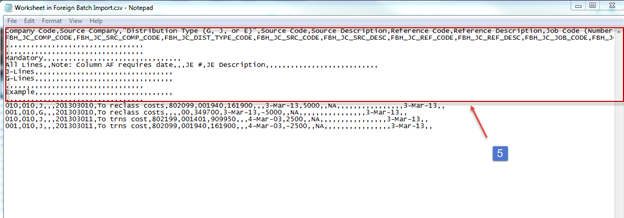

STEP 5: Highlight and delete all lines other than detail lines (including header). Leave only the coded JE lines.

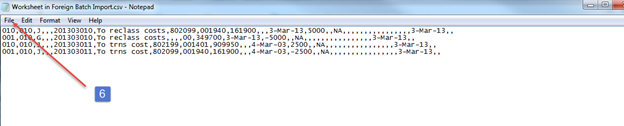

STEP 6: Save as .txt file

STEP 7: Enter File Name. Change extension from “csv” to “txt”

STEP 8: Click Save

CMiC Foreign Batch Import

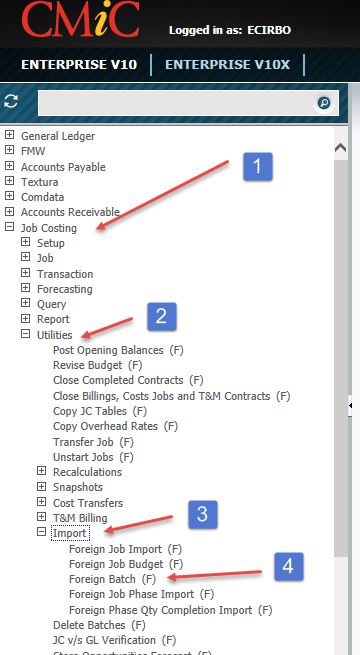

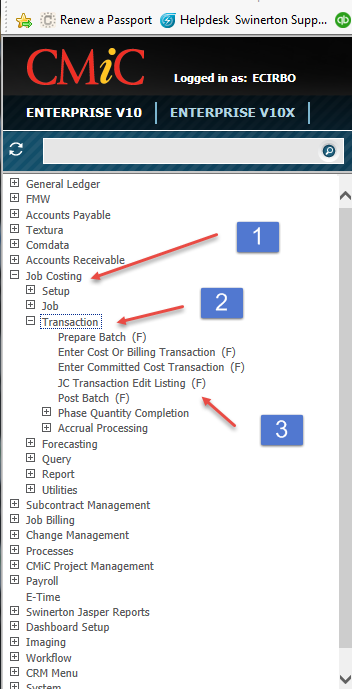

STEP 1: Click Job Costing

STEP 2: Click Utilities

STEP 3: Click Import

STEP 4: Click Foreign Batch

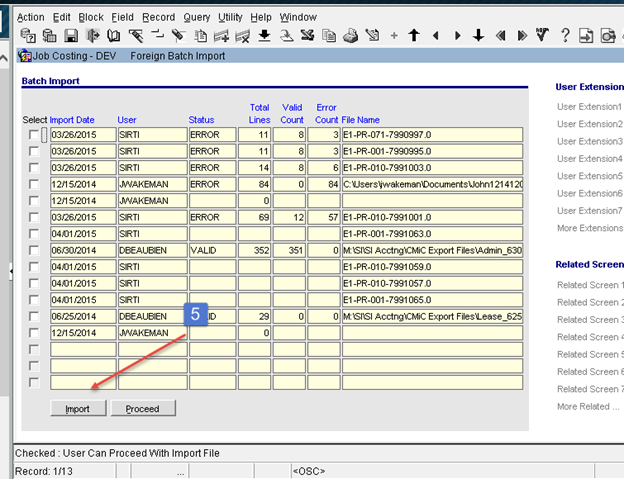

STEP 5: Click Import

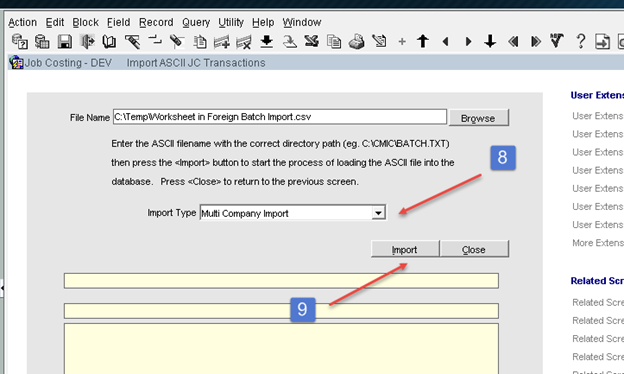

STEP 6: Click Browse and locate file saved in steps above.

STEP 7: Highlight file and click Open

STEP 8: Import Type defaults to Multi Company Import.

STEP 9: Click Import

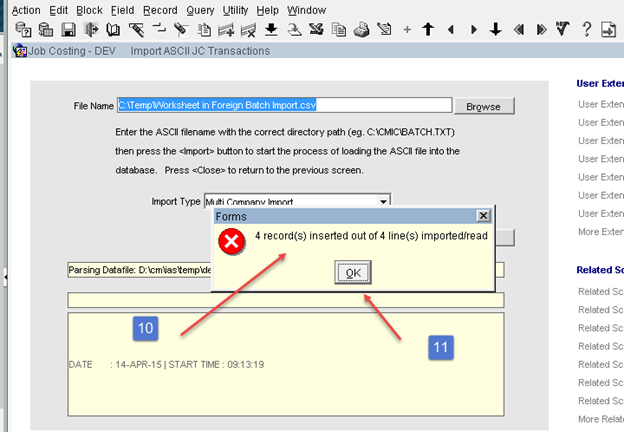

STEP 10: Confirm all lines imported

STEP 11: Click OK

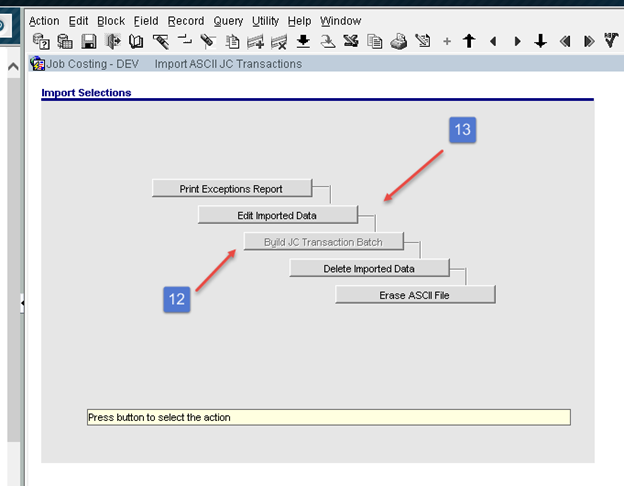

STEP 12: If Batch is not in error, Build JC Transaction Batch will not be grayed out. In this case there is an error in the batch that must be corrected. If ‘Build JC Transaction is accessible skip to the step 31 below. Steps 13 – 30 show how to correct a file.

STEP 13: Click Edit Imported Data

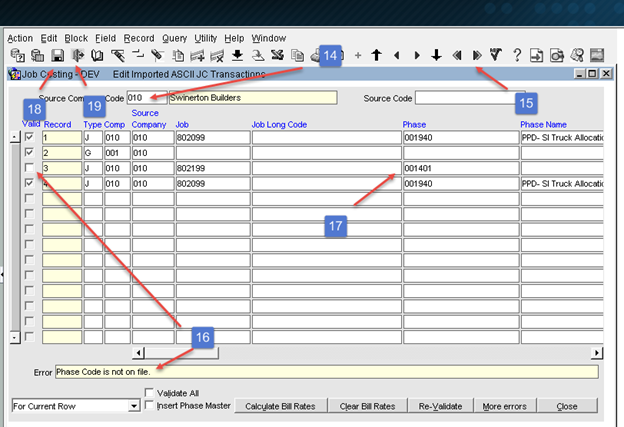

STEP 14:Source Company Code - Enter Company # used as Source company in file.

STEP 15: Page down or click the Next Block icon. Data will populate.

STEP 16: Records with errors will not have a check mark in the Valid box. See error(s) at bottom of page.

STEP 17: In this case, a record three has an invalid Phase Code. This must be corrected prior to proceeding.

STEP 18: Once corrected, Click Save

STEP 19: Click Close

STEP 20: Click Close

STEP 21: Go back into Job Cost, Import, Foreign Batch (see above Steps 1 -4 above).

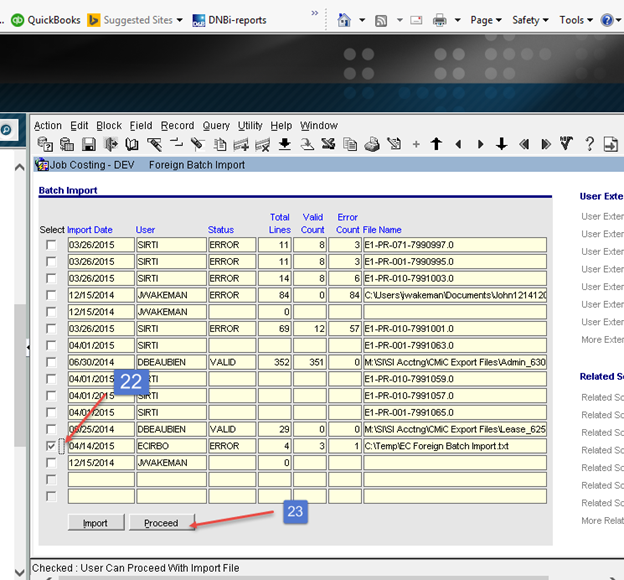

STEP 22: Locate your batch and click the Select box

STEP 23:Click Proceed

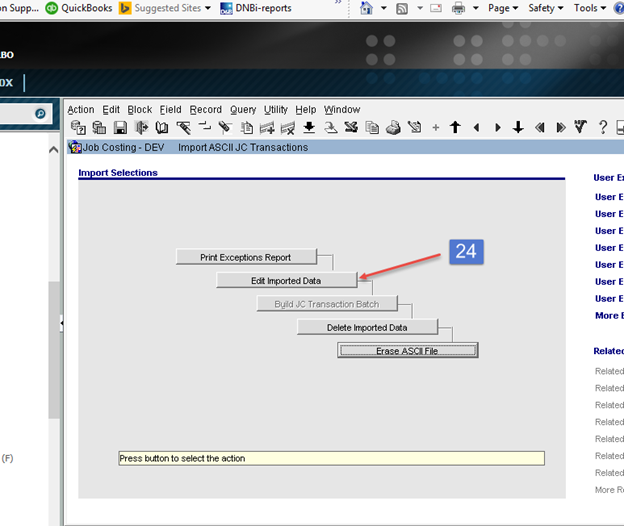

STEP 24:Click Edit Imported Data

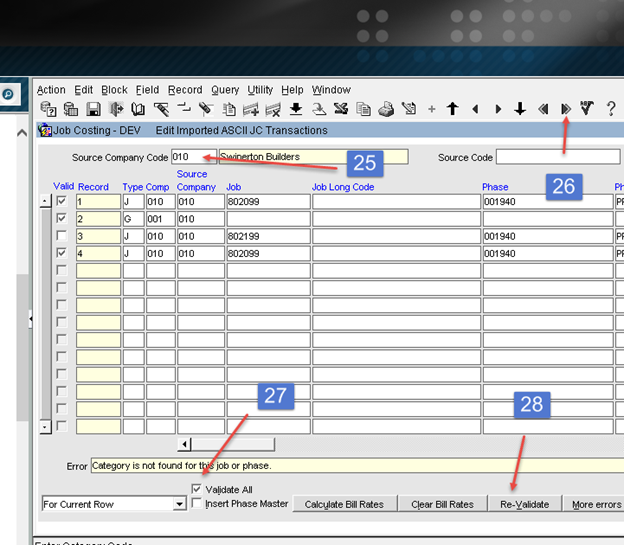

STEP 25: Source Company Code – Enter source code used in your file

STEP 26: Page down or click the Next Block icon

STEP 27: Check Validate All box

STEP 28: Click Re-Validate

All boxes should be valid. If not, repeat the steps above.

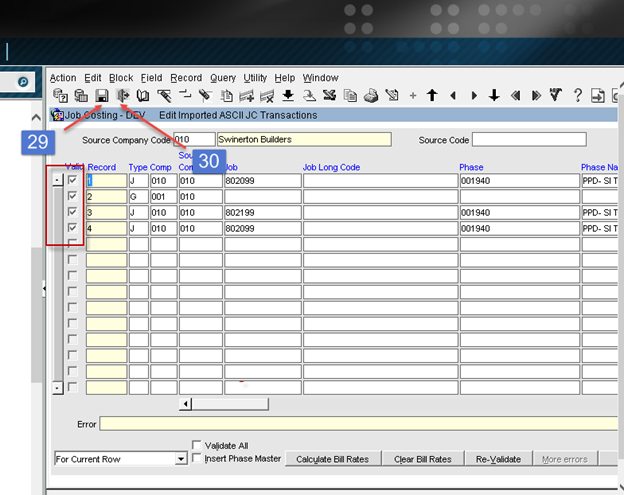

STEP 29: Click Save

STEP 30: Click Close

Build JC Transaction Batch should be available if no errors are found.

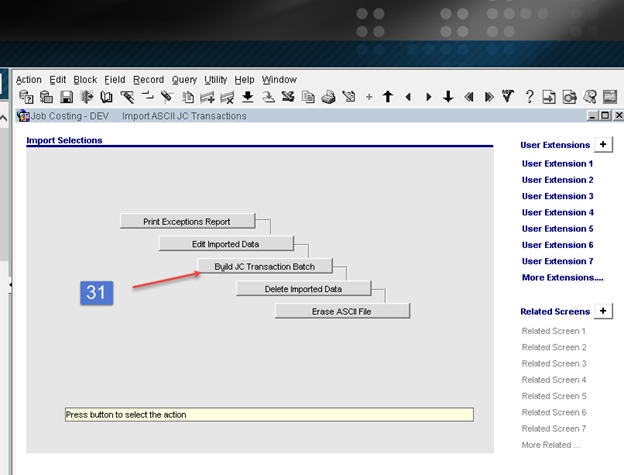

STEP 31: Click Build JC Transaction Batch

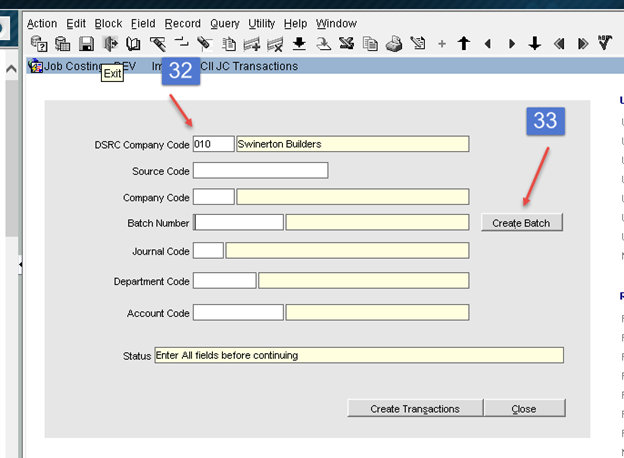

STEP 32: Enter DSRC Company Code

STEP 33: Click Create Batch

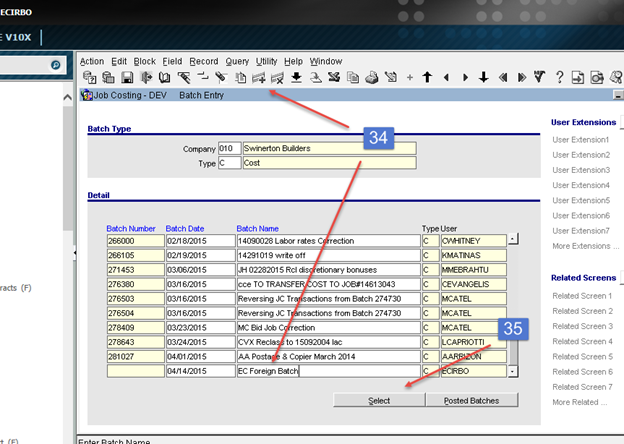

STEP 34: Enter Batch Name on last line or click insert icon to add batch

STEP 35: Click Select

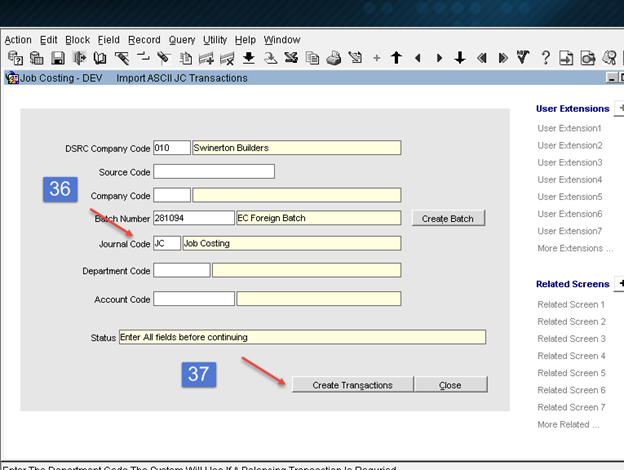

STEP 36: Journal Code – Enter JC

STEP 37: Click Create Transactions

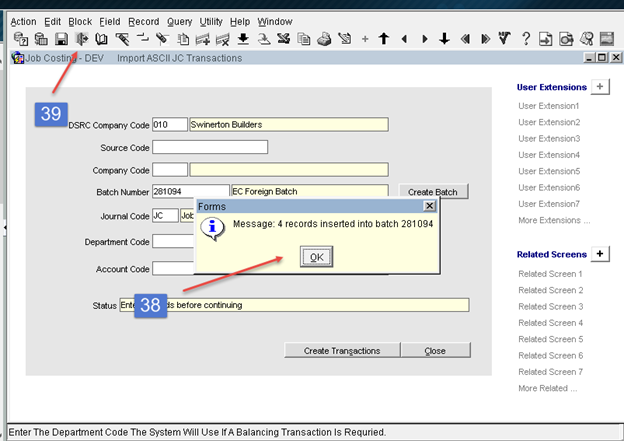

STEP 38: Click OK.

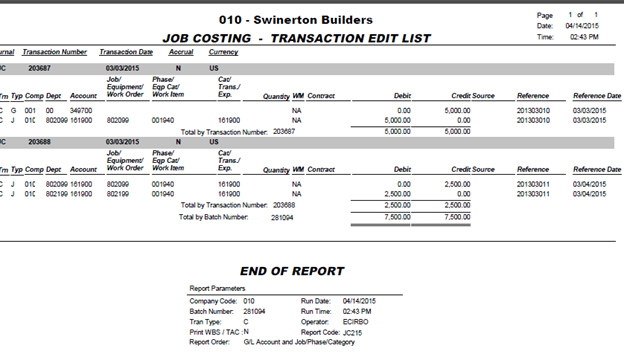

Note that correct number of records were inserted and note batch number.

STEP 39: Click Close.

Print JC

Transaction Edit Listing – Validate Data

STEP 1: Click Job Costing

STEP 2: Click Transaction

STEP 3: Click JC Transaction Edit

Listing

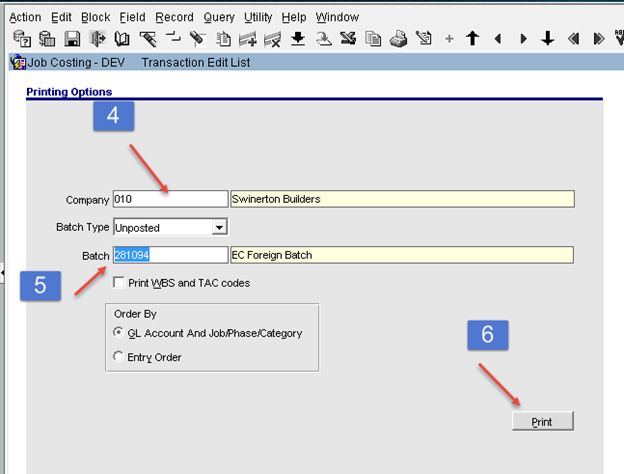

STEP 4: Confirm Company number. Defaults from setup. Change if necessary.

STEP 5: Enter Batch number create above or query

STEP 6: Click Print

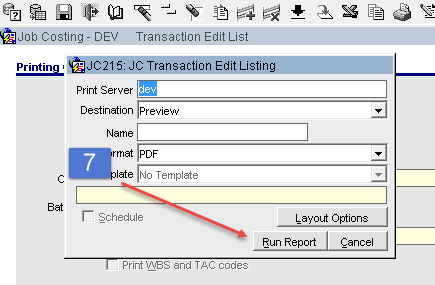

STEP 7: Click Run Report and

validate data prior to posting.

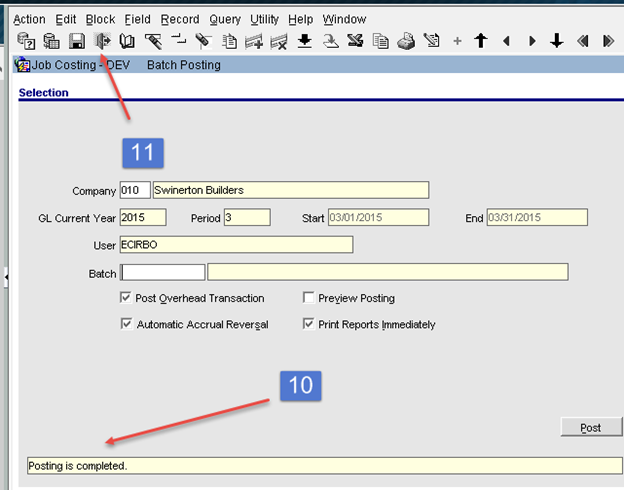

Post

Batch

STEP 1: Click Job Costing

STEP 2: Click Transaction

STEP 3: Click Post Batch

STEP 4: Confirm Company number. Defaults from setup. Change if necessary.

STEP 5: GL

Current Year and Period – Defaults to

open period

STEP 6: Enter Batch number create above or query

STEP 7: Automatic Accrual Reversal –

Uncheck

STEP 8: Print Reports Immediately – Check if you would like to view posting reports

STEP 9: Click Post

If you checked Print

Reports Immediately, you will be prompted to run reports.

STEP 10: You will receive a message that Posting is completed.

STEP 11: Click Close